Anyone can request an automatic tax-filing extension, but some people get extra time without asking, according to the Internal Revenue Service. Due to the ongoing pandemic, this year the IRS postponed the usual April 15 deadline for filing individual income tax returns until May 17, 2021. Even so, as is the case every year, many Americans will still need more time to meet their tax-filing obligation.

Continue readingCategory Archives: efile income tax extension

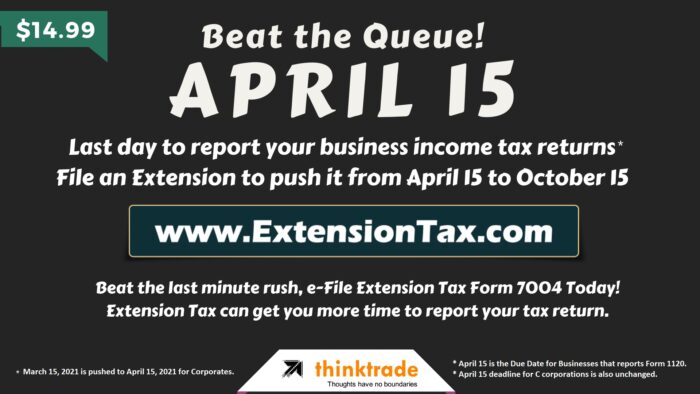

April 15 Due Date for Businesses reporting IRS Tax Form 1120

The RS is once again moving the income tax filing deadline to allow more time to complete and submit your tax return and to pay any taxes you may owe. This year, individual taxpayers, including sole proprietors and single-owner LLCs, who normally have to file their tax return by April 15 will have until May 17, 2021 to file their 2020 taxes.

Many businesses, including most S corporations and partnerships, have a tax filing deadline of March 15. This deadline is unchanged, since the change was announced after this deadline passed. The April 15 deadline for C corporations is also unchanged.

April 15 deadline for C corporations is also unchanged.

Most businesses and self-employed individuals must submit estimated tax payments quarterly and file an income tax return annually. Filing dates depend on whether you operate a corporation, partnership, S corporation, or sole proprietorship.

Sole proprietorships use the same tax schedule as individuals, so 2020 returns are due on April 15, 2021. If your business is an S corporation or a partnership, the return is due on March 15, 2021. Corporations can have various tax filing deadlines, and it should be defined in your corporate resolution. S corporations and partnerships, have a tax filing deadline of March 15. This deadline is unchanged, since the change was announced after this deadline passed.

April 15 deadline for C corporations is also unchanged.

Corporate income tax returns

Companies have until April 15, 2021 to submit corporate tax returns for income received in 2020. Businesses may use Form 1120 or request a six-month extension by filing Form 7004 and submitting a deposit for the amount of estimated tax owed. The first quarterly estimated tax payment of the year is also due on this date. If your business requests an extension, you have until October 15 to submit your income tax return using Form 1120. You’ll be required to pay penalties, interest, and any remaining tax at that time.

Federal excise tax requirements for small businesses

Federal excise taxes apply to a number of different products and industries. Filing requirements vary depending on the nature of your business. Form 720, Quarterly Federal Excise Tax Return, applies to retailers, manufacturers, communications companies, and travel services. It’s filed quarterly, with this year’s due dates falling on April 30, July 30, October 29, 2021, and January 31, 2022.

Q1 Form 720 – Federal Excise Tax Filing Falls Due This April 30, 2021. Use TaxExcise.com to eFile and receive instant acknowledgement.

IRS reminds taxpayers to make April 15 estimated tax payment

The Internal Revenue Service today reminded self-employed individuals, retirees, investors, businesses, corporations and others who pay their taxes quarterly that the payment for the first quarter of 2021 is due Thursday, April 15, 2021.

The extension to May 17, 2021 for individuals to file their 2020 federal income taxes does not apply to estimated tax payments. The 2021 Form 1040-ES, Estimated Tax for Individuals, can help taxpayers estimate their first quarterly tax payment.

The deadline to file an extension for C-corporation income tax returns (IRS Form 1120) is April 15, 2021. E-file now!

To give employers more cash in their paychecks, businesses were given the option to postpone withdrawing the employee’s share of payroll taxes on salaries earned between September 1, 2020, and December 31, 2020. Beginning March 27, 2020, you were given the option to delay the employer’s share of payroll taxes. Payroll taxes suspended during this time frame must be collected by April 30, 2021. To offset the balance that was withheld last year, you’ll need to subtract extra payroll tax from workers’ checks for the first four months of 2021. These taxes should be deposited in accordance with the daily salary withholding plan.

The tax filing deadline was March 15 for several companies, like most S corporations and partnerships. Since the move was announced after the deadline, this deadline remained unchanged. For C corporations, the April 15 deadline remains the same. Since sole proprietorships follow the same tax code as corporations, their 2020 returns must be filed by April 15, 2021. By filing Form 7004 along with a deposit equal to the amount of expected tax due, partnerships and S corporations may seek a six-month extension. The annual tax return, with interest and fees, is due on September 15 in this situation. Corporate tax returns for taxes earned in 2020 must be submitted by April 15, 2021. Businesses may use Form 1120 or file Form 7004 to make a deposit for the amount of expected tax owed to seek a six-month extension. This is also the deadline for the first quarterly projected tax payment of the year. You have until October 15 to file your income tax return using Form 1120 if your company has requested an extension. At this point, you’ll have to pay fines, interest, and any residual tax.

Continue readingThe deadline to file Form 1120-Scorp and Form 1065 Partnership tax extension is Today, March 15th, E-file Now!

The deadline to file Form 1120-Scorp and Form 1065 Partnership tax extension is today, March 15th, and it’s not too late to e-file an extension with www.Extensiontax.com if you need more time. Breaking a tax deadline will result in substantial fines and interest.

With less time to E-file Form 7004 for Tax Year 2020, the safest way to get it completed on time and escape the pitfalls of Interests & Fines is to use www.Extensiontax.com – A Think Trade Inc, product, an IRS Approved E-file Service Provider for E-filing Federal Extension Tax Forms & Excise Tax Forms.

Continue reading