If we are paying attention to our lives, we’ll recognize those defining moments. The challenge for so many of us is that we are so deep into daily distractions and ‘being busy, busy’ that we miss out on those moments and opportunities that – if jumped on – would get our careers and personal lives to a whole new level of wow. In today’s modern lifestyle almost every individual cribs stating that 24 hours a day is not enough to take care of their daily chores.

If we are paying attention to our lives, we’ll recognize those defining moments. The challenge for so many of us is that we are so deep into daily distractions and ‘being busy, busy’ that we miss out on those moments and opportunities that – if jumped on – would get our careers and personal lives to a whole new level of wow. In today’s modern lifestyle almost every individual cribs stating that 24 hours a day is not enough to take care of their daily chores.

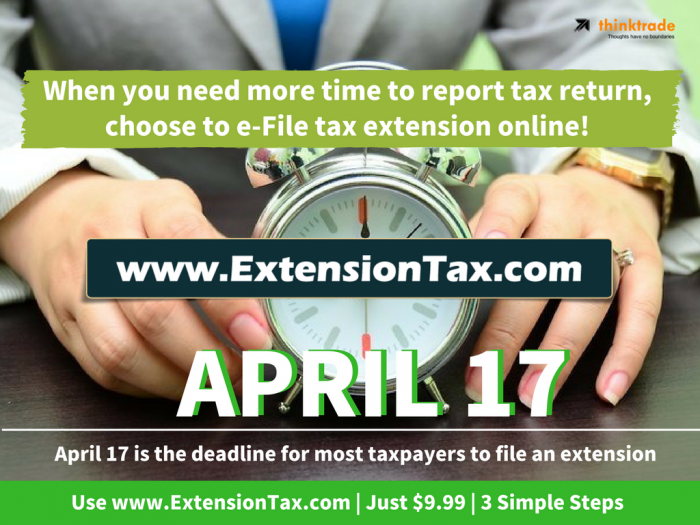

Month of April is here and your Personal Income Tax is due in another 15 days. You read that right this year the tax due date is April 17th not April 15th, thanks to the weekend and the following federal holiday. Well, though the due date is postponed by two days is that really enough for you to gather all the required paper works and file your Personal Income Tax on time without any mistakes. We can hear that loud “NO” so can the IRS. Continue reading

The exact Phrase to explain how tax extensions work is Filing for a Tax extension is “May I place you on hold for a while”. Filing for an Extension is nothing but keeping the IRS informed that you will file your Tax returns after a while. You may have more than enough money to pay off your Taxes but, you may not have the required paper works ready by the Due date. Extensions are more likely to be a gift given to tax payers by the IRS and the best way to file for it is through ExtensionTax.com.

The exact Phrase to explain how tax extensions work is Filing for a Tax extension is “May I place you on hold for a while”. Filing for an Extension is nothing but keeping the IRS informed that you will file your Tax returns after a while. You may have more than enough money to pay off your Taxes but, you may not have the required paper works ready by the Due date. Extensions are more likely to be a gift given to tax payers by the IRS and the best way to file for it is through ExtensionTax.com.