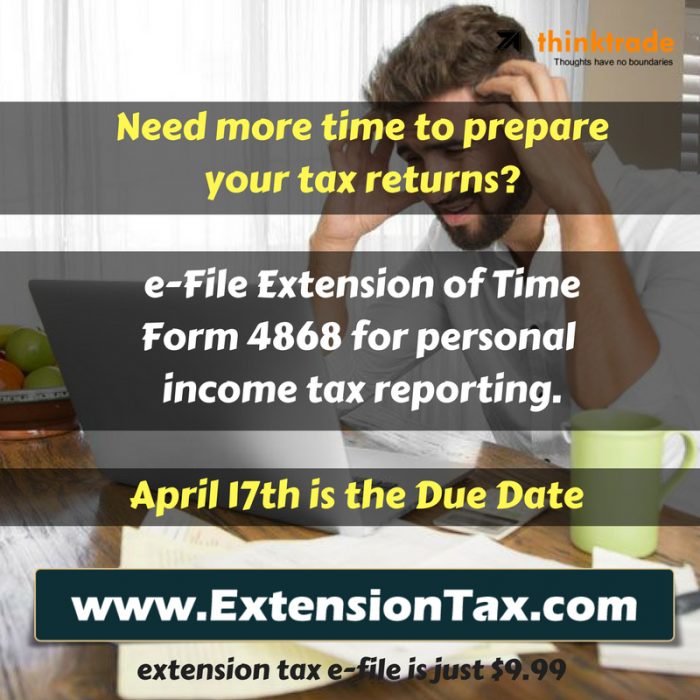

The Internal Revenue Service reminds taxpayers who may have trouble meeting the April 17 tax filing deadline that e-File provides an easy, online option to get more time. Taxpayers submitting Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, will automatically be granted a six-month filing extension.

This is the seventh in a series of nine IRS news releases called the Tax Time Guide, designed to help taxpayers navigate common tax issues. The IRS offers the extra time to file, automatically, to all taxpayers requesting it. A filing extension allows taxpayers until Oct. 15 to gather, prepare and file their taxes with the IRS. However, it does not extend the time to pay any tax due.

Applying for an extension requires to complete Form 4868, with your personal information such as name, address and Social Security number. Also tax related info, about estimated tax liability, payments and residency. Taxpayers can make this extension request electronically at http://ExtensionTax.com at just $9.99. e-File would be the fastest and easiest way of filing your tax extension request. Continue reading