Form 7004 Business Income Tax Extension – A Complete Overview

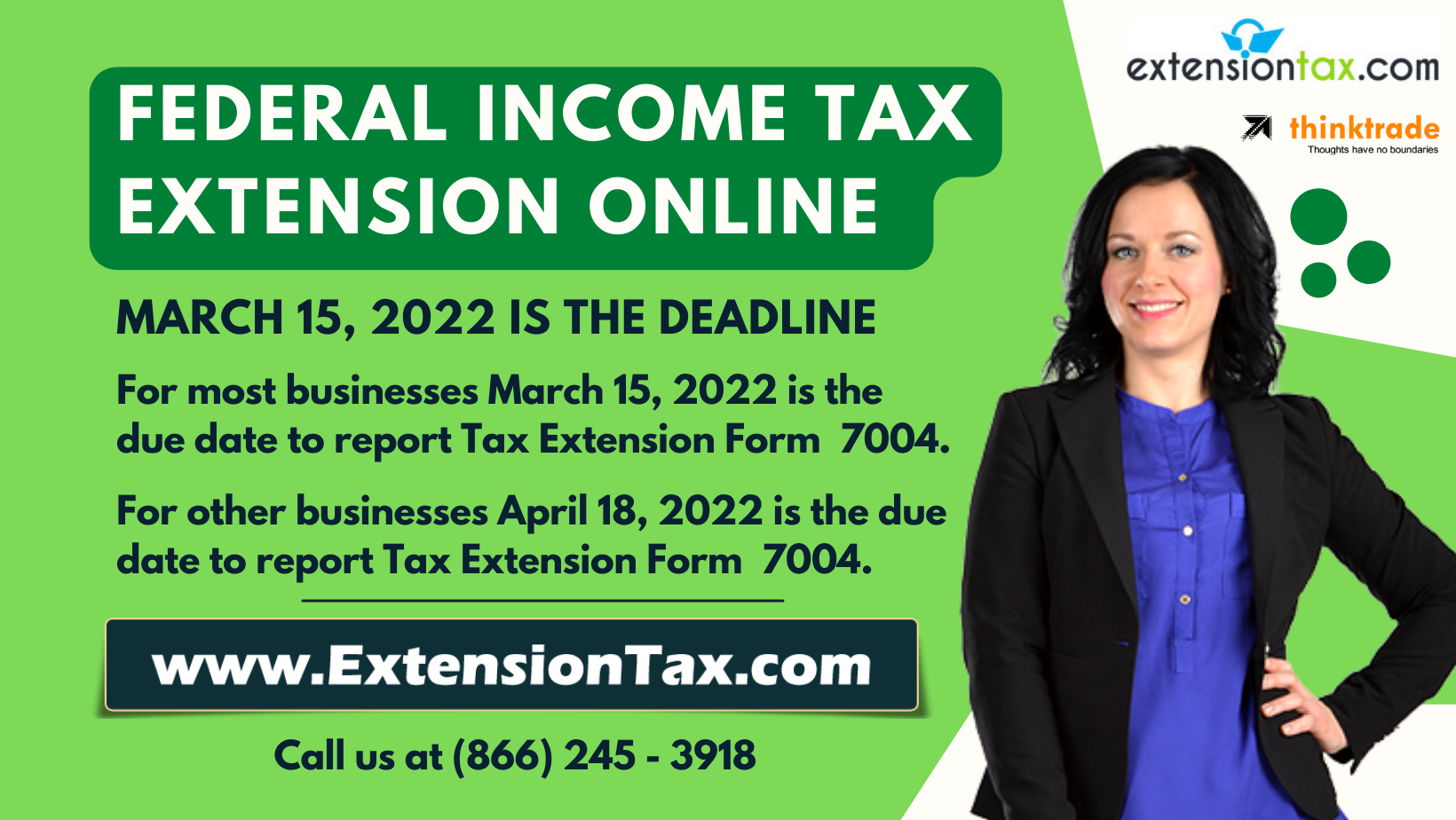

Filing for business extension tax is essential for all businesses when they cannot complete their tax reports on time. Because businesses face many challenges while filing their tax reports perfectly with the IRS, the time constraint is the major challenge. And the deadline is nearby to pay and file your complete business income tax returns. Every year IRS keeps the deadline on the 15th of the third month, which is March 15, 2022 (for S-Corp, LLC’s etc), for few business owners to file their business income taxes, others it is April 18,2022 (for Corporates etc). For the businesses that cannot submit the tax returns on time, IRS gives an automatic tax extension time to complete all the formalities and submit the tax reports properly.