Hello business taxpayers! Today is the last date to report your business income tax extension form 7004. Many businesses file for business income tax extension form 7004 to get the automatic six months extension time from the IRS because they can’t report the tax returns with all supporting documents and proofs.

Among the many businesses, the last day to apply for business income extension tax form 7004 is today for the companies like LLCs, S-Corporations, Partnership firms to get the automatic six-month tax extension till September 15, 2023.

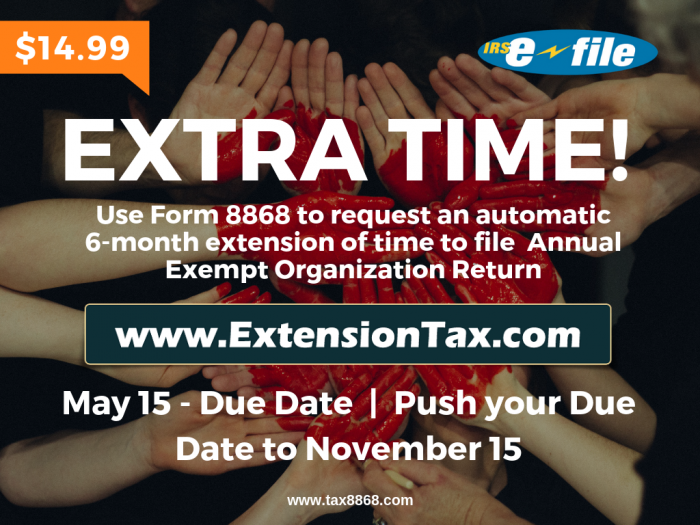

May 15th is the deadline to file your Non-Profit Organization Income Tax Return and if you need more time to file, it’s not too late to e-file for an extension with

May 15th is the deadline to file your Non-Profit Organization Income Tax Return and if you need more time to file, it’s not too late to e-file for an extension with  2019 is 100 days old already and your Personal Income taxes are due in less than a week’s time. Exactly by Monday that is the 15th April 2019, you have to file & pay your Personal Income Tax. If not you are not really going to enjoy the rest of the year.

2019 is 100 days old already and your Personal Income taxes are due in less than a week’s time. Exactly by Monday that is the 15th April 2019, you have to file & pay your Personal Income Tax. If not you are not really going to enjoy the rest of the year.