“Its tax time again, Americans: time to gather up those receipts, get out those tax forms, sharpen up that pencil, and stab yourself in the aorta” – Dave Barry.

“Its tax time again, Americans: time to gather up those receipts, get out those tax forms, sharpen up that pencil, and stab yourself in the aorta” – Dave Barry.

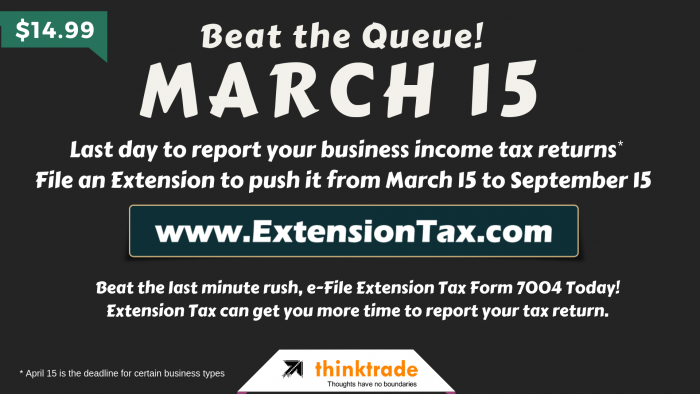

It is not at all wrong to have a thought to file your business income taxes on time, but one should make sure that they file it correctly with all the required supporting documents & pay their taxes on or before the deadline that falls on March 15th to safeguard themselves from IRS penalties & interests. Only very few have all the necessary documents handy to submit their Business Income Taxes on time. What about Others?

Well, it is a well known fact that most of us fall under the others category mentioned above. Here is what you can do to protect yourself from IRS penalties & Interests. E-file Form 7004 – Extension of Time, to file your Federal Business Income Tax. It is the only available solution to legally procrastinate your Tax filing. How to file it? Even simpler www.Extensiontax.com that’s where you can get it done within minutes. Continue reading

“This is the season of the year when we discover that we owe most of our success to Uncle Sam” – The Wall Street Journal

“This is the season of the year when we discover that we owe most of our success to Uncle Sam” – The Wall Street Journal