The Internal Revenue Service already announced that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. When your Income Tax Extension Form 4868 is approved you’ll have until October 15, 2021 to file your return but you still need to pay any taxes owed by May 17.

Continue readingTag Archives: Tax Extension

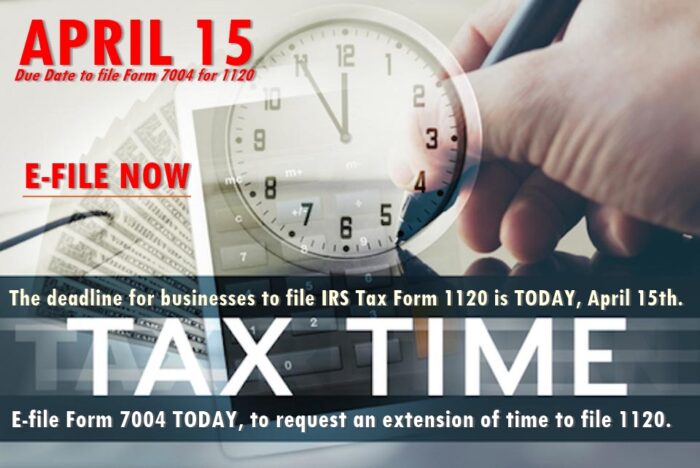

TODAY, April 15, is the deadline for Form 7004 extension of time for Form 1120 C-corp. Now is the time to file electronically!

There is a pressing need to act quickly because there isn’t much time left to file the C-corporation Form 1120 income tax return or an Extension Form 7004 for C-corporation 1120 to seek a filing extension. It’s not unfair to choose to save your hard-earned money for as long as possible, so you can make sure that you register and pay your taxes on or before the deadline to avoid IRS fines and interest. Keep one step ahead of the IRS by e-filing for an automatic 6-month extension of time to file the income tax returns. The deadline to file your C-corporation income tax returns (IRS Form 1120) is TODAY, April 15, 2021. The deadline to apply for a Form 7004 extension, which is an automatic extension of time for Form 1120, is also TODAY, April 15.

Continue readingThe deadline to file an extension for C-corporation income tax returns (IRS Form 1120) is April 15, 2021. E-file now!

To give employers more cash in their paychecks, businesses were given the option to postpone withdrawing the employee’s share of payroll taxes on salaries earned between September 1, 2020, and December 31, 2020. Beginning March 27, 2020, you were given the option to delay the employer’s share of payroll taxes. Payroll taxes suspended during this time frame must be collected by April 30, 2021. To offset the balance that was withheld last year, you’ll need to subtract extra payroll tax from workers’ checks for the first four months of 2021. These taxes should be deposited in accordance with the daily salary withholding plan.

The tax filing deadline was March 15 for several companies, like most S corporations and partnerships. Since the move was announced after the deadline, this deadline remained unchanged. For C corporations, the April 15 deadline remains the same. Since sole proprietorships follow the same tax code as corporations, their 2020 returns must be filed by April 15, 2021. By filing Form 7004 along with a deposit equal to the amount of expected tax due, partnerships and S corporations may seek a six-month extension. The annual tax return, with interest and fees, is due on September 15 in this situation. Corporate tax returns for taxes earned in 2020 must be submitted by April 15, 2021. Businesses may use Form 1120 or file Form 7004 to make a deposit for the amount of expected tax owed to seek a six-month extension. This is also the deadline for the first quarterly projected tax payment of the year. You have until October 15 to file your income tax return using Form 1120 if your company has requested an extension. At this point, you’ll have to pay fines, interest, and any residual tax.

Continue readingTax Day for individuals extended to May 17: Treasury, IRS extend filing and payment deadline

WASHINGTON — The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. The IRS will be providing formal guidance in the coming days.

“This continues to be a tough time for many people, and the IRS wants to continue to do everything possible to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities,” said IRS Commissioner Chuck Rettig. “Even with the new deadline, we urge taxpayers to consider filing as soon as possible, especially those who are owed refunds. Filing electronically with direct deposit is the quickest way to get refunds, and it can help some taxpayers more quickly receive any remaining stimulus payments they may be entitled to.”

Continue readingIRS extends April 15 and other upcoming deadlines, provides other tax relief for victims of Texas winter storms

Victims of this month’s winter storms in Texas will have until June 15, 2021, to file various individual and business tax returns and make tax payments, the Internal Revenue Service announced today.

Following The recent disaster declaration issued by the Federal Emergency Management Agency (FEMA), the IRS is providing this relief to the entire state of Texas. But taxpayers in other states impacted by these winter storms that receive similar FEMA disaster declarations will automatically receive the same filing and payment relief. The current list of eligible localities is always available on the disaster relief page on IRS.gov.

Continue reading