It’s a good idea to have all your tax documents together before preparing your 2012 tax return. You will need your W-2, Wage and Tax Statement, which employers should send by the end of January. Give it two weeks to arrive by mail.

If you have not received your W-2, follow these three steps:

1. Contact your employer first. Ask your employer – or former employer – to send you your W-2 if it has not already been sent. Make sure your employer has your correct address.

2. Contact the IRS. After February 14, you may call the IRS at 800-829-1040 if you have not yet received your W-2. Be prepared to provide your name, address, Social Security number and phone number. You should also have the following information when you call:

• Your employer’s name, address and phone number;

• Your employment dates; and

• An estimate of your wages and federal income tax withheld in 2012, based upon your final pay stub or leave-and-earnings statement, if available.

3. File your return on time. You should still file your tax return on or before April 15, 2013, even if you have not yet received your W-2. File Form 4852, Substitute for Form W-2, Wage and Tax Statement, in place of the W-2. Use the form to estimate your income and withholding taxes as accurately as possible. The IRS may delay processing your return while it verifies your information.

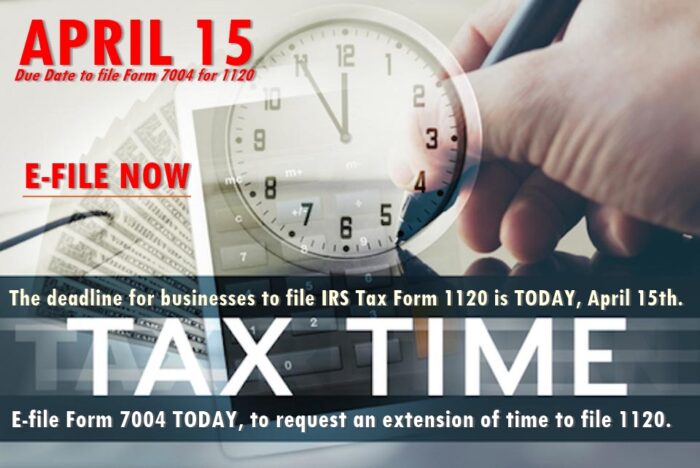

If you need more time to file, you can get a six-month extension of time. File Form 4868, Application for Automatic Extension of Time to File US Individual Income Tax Return. If you are requesting an extension, you must file this form on or before April 15, 2013.

The Best way to file for an extension is E-filing through www.extensiontax.com, where your returns get accepted by the IRS within minutes. Extensiontax.com is now ready to accept and process Form 4868 for 2012. Do not wait till April to file for an extension, E-file it right away and stay relaxed till October 15. Call 1-866-245-3918 for all your tax extension related questions or write to support@extensiontax.com.

April 18 Filing Deadline is Fast Approaching; Just have two weeks remaining until the April 18 filing deadline. Act Fast and get easy 6-months extension by efiling Form 4868 through

April 18 Filing Deadline is Fast Approaching; Just have two weeks remaining until the April 18 filing deadline. Act Fast and get easy 6-months extension by efiling Form 4868 through