Here is the latest IRS new alert under Issue Number:IR-2018-50 and under this issue…

WASHINGTON — The Internal Revenue Service today granted many businesses affected by severe winter storms additional time to request a six-month extension to file their 2017 federal income tax returns.

The IRS is providing this relief to victims and tax professionals affected by last week’s storm–known as Winter Storm Quinn—and this week’s storm –known as Winter Storm Skylar–that primarily hit portions of the Northeast and Mid-Atlantic.

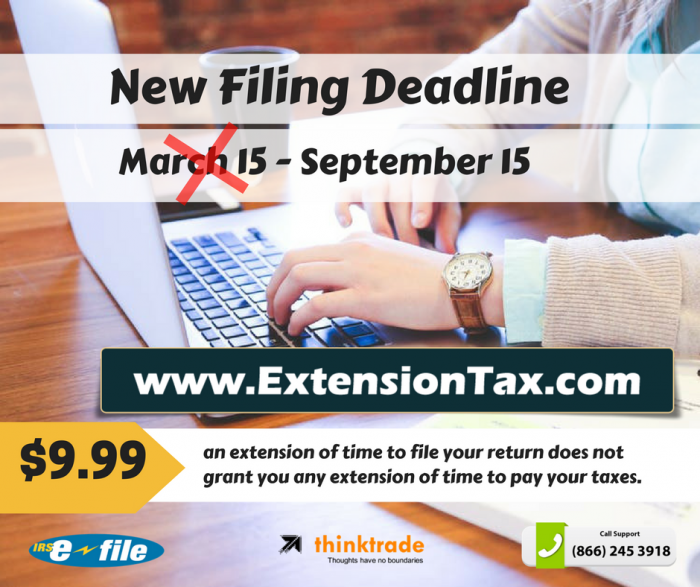

Business taxpayers who are unable to file their return by the regular due date—Thursday, March 15, 2018–can request an automatic extension by filing Form 7004, on or before Tuesday, March 20, 2018. Form 7004, available on IRS.gov, provides a six-month extension for returns filed by partnerships (Forms 1065and 1065-B) and S corporations (Form 1120S).

Eligible taxpayers taking advantage of this relief should write, “Winter Storm Quinn” or “Winter Storm Skylar,” on their Form 7004 extension request (if filing this form on paper). As always, the fastest and easiest way to get an extension is to file this form electronically.

The IRS will continue to monitor conditions and provide additional relief if circumstances warrant.

The exact Phrase to explain how tax extensions work is Filing for a Tax extension is “May I place you on hold for a while”. Filing for an Extension is nothing but keeping the IRS informed that you will file your Tax returns after a while. You may have more than enough money to pay off your Taxes but, you may not have the required paper works ready by the Due date. Extensions are more likely to be a gift given to tax payers by the IRS and the best way to file for it is through ExtensionTax.com.

The exact Phrase to explain how tax extensions work is Filing for a Tax extension is “May I place you on hold for a while”. Filing for an Extension is nothing but keeping the IRS informed that you will file your Tax returns after a while. You may have more than enough money to pay off your Taxes but, you may not have the required paper works ready by the Due date. Extensions are more likely to be a gift given to tax payers by the IRS and the best way to file for it is through ExtensionTax.com. March 15th will be the deadline to file your business income tax return and if you need more time to file, it’s not too late to e-file an extension with

March 15th will be the deadline to file your business income tax return and if you need more time to file, it’s not too late to e-file an extension with