“It’s tax time. I know this because I’m staring at documents that make no sense to me, no matter how many beers I drink.” – Dave Barry. The day Dave was quoting is about to haunt you in another 3 days. YES! You read that right, March 15th, is your deadline to file and pay your Business Income taxes for 2017. Not everyone is prepared to file their Business Income Taxes, due to lack of paper work or lack of time. Continue reading

The exact Phrase to explain how tax extensions work is Filing for a Tax extension is “May I place you on hold for a while”. Filing for an Extension is nothing but keeping the IRS informed that you will file your Tax returns after a while. You may have more than enough money to pay off your Taxes but, you may not have the required paper works ready by the Due date. Extensions are more likely to be a gift given to tax payers by the IRS and the best way to file for it is through ExtensionTax.com.

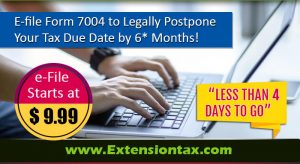

The exact Phrase to explain how tax extensions work is Filing for a Tax extension is “May I place you on hold for a while”. Filing for an Extension is nothing but keeping the IRS informed that you will file your Tax returns after a while. You may have more than enough money to pay off your Taxes but, you may not have the required paper works ready by the Due date. Extensions are more likely to be a gift given to tax payers by the IRS and the best way to file for it is through ExtensionTax.com. March 15th will be the deadline to file your business income tax return and if you need more time to file, it’s not too late to e-file an extension with

March 15th will be the deadline to file your business income tax return and if you need more time to file, it’s not too late to e-file an extension with