Hello business taxpayers! The deadline to apply for a business income tax extension for tax–exempted organizations is May 15, 2023, and it is just a few days away. Taxpayers for their tax–exempted organizations must use the business tax extension Form 8868 to apply for extension time to file their tax reports. Therefore, if you are a business taxpayer, you must use Form 8868 to get an automatic six-month extension from the IRS to report your taxes. Also, you can use this Form 8868 to apply for a non-automatic three-month extension if the original automatic extension was insufficient to file your tax reports.

Tag Archives: tax-exempt organizations

Form 8868 Business Tax Extension Application is Due for Tax Exempted Organizations.

Hello taxpayers! If you need extra time to report the taxes for your tax-exempted organizations, you must file form 8868 within the deadline to get the automatic six–month extension to report your taxes to the IRS. Certain organizations and businesses like charities, non–profits, educational institutions, healthcare organizations, and others are not entitled to tax payments. But they need to submit their tax reports through their original tax forms within the deadline and get the proper acceptance from the IRS. Or apply for business extension tax form 8868 to get the extension time within the same deadline. The last date to report form 8868 for tax exempted organizations is May 15, 2023.

Business Tax Extension Form 8868 is due by May 15, 2023, for Tax-Exempt Organizations.

Hello business taxpayers! The last date to apply for the business income tax extension form 8868 for your tax-exempted organizations is coming soon. Certain business organizations are not entitled to pay taxes to the federal government and are exempted from tax payments to the IRS. Tax–exempted organizations don’t have to pay any taxes, but they have to file their tax reports to the IRS every year within the deadline. If they can’t submit the tax reports through the original form by the last date, they should apply for form 8868 to get an extension to report the business income taxes.

Things organizations should know about applying for tax-exempt status

To be tax-exempt under Section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for any of these purposes: charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, or preventing cruelty to children or animals.

Organizations that want to apply for recognition of tax-exempt status under Section 501(c)(3) use a Form 1023-series application.

Continue reading

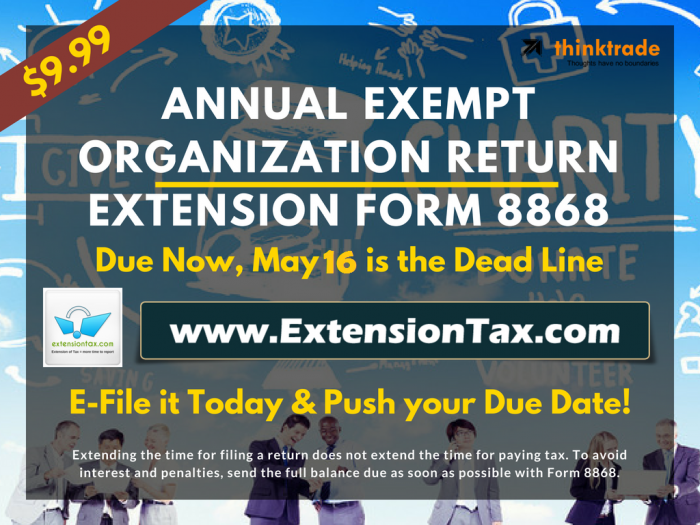

May 16 is filing deadline for many tax-exempt organizations

The Internal Revenue Service today reminded tax-exempt organizations that many have a filing deadline of May 16, 2022. Those that operate on a calendar-year (CY) basis have certain annual information and tax returns they file with the IRS. These returns are:

- Form 990-series annual information returns (Forms 990, 990-EZ, 990-PF)

- Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt Organizations Not Required to File Form 990 or Form 990-EZ

- Form 990-T, Exempt Organization Business Income Tax Return (other than certain trusts)

- Form 4720, Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code