“This is the season of the year when we discover that we owe most of our success to Uncle Sam” – The Wall Street Journal

“This is the season of the year when we discover that we owe most of our success to Uncle Sam” – The Wall Street Journal

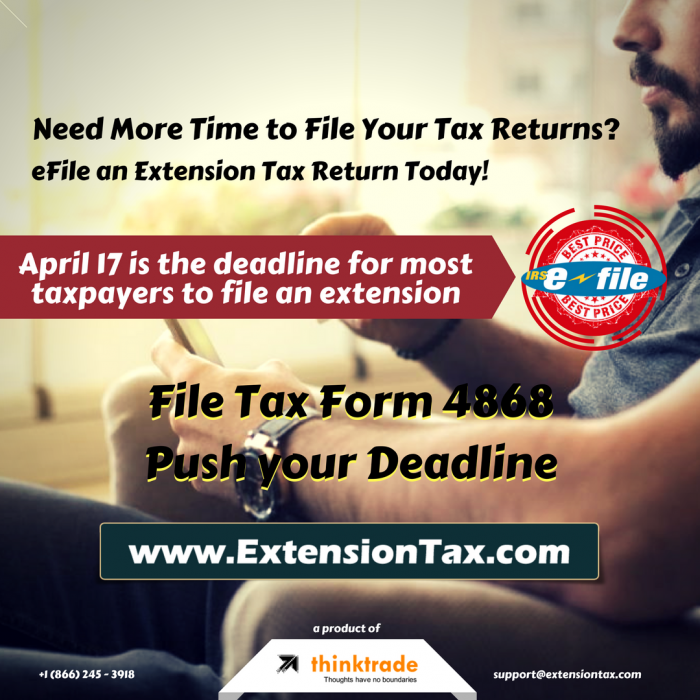

Filing for an Extension means legally postponing your tax Deadline to a future date. E-Filing for an Extension is nothing but keeping the IRS informed that you will file your Tax returns after a while. You may have more than enough money to pay off your Taxes but, you may not have the required paper works ready by the Due date. Extensions are more likely to be a gift given to tax payers by the IRS and the best way to file for it is through ExtensionTax.com.

www.ExtensionTax.com is an IRS authorized E-file service provider that supports E-filing for Extensions Online. Millions of taxpayers are benefited by this user friendly, hassle free application by E-filing their Tax extensions. The online portal has been designed in such a way that complex tax jargon s are broken into simple understandable words, which makes it easier for a common man to file for an Extension.

What all can be done through www.ExtensionTax.com : Continue reading