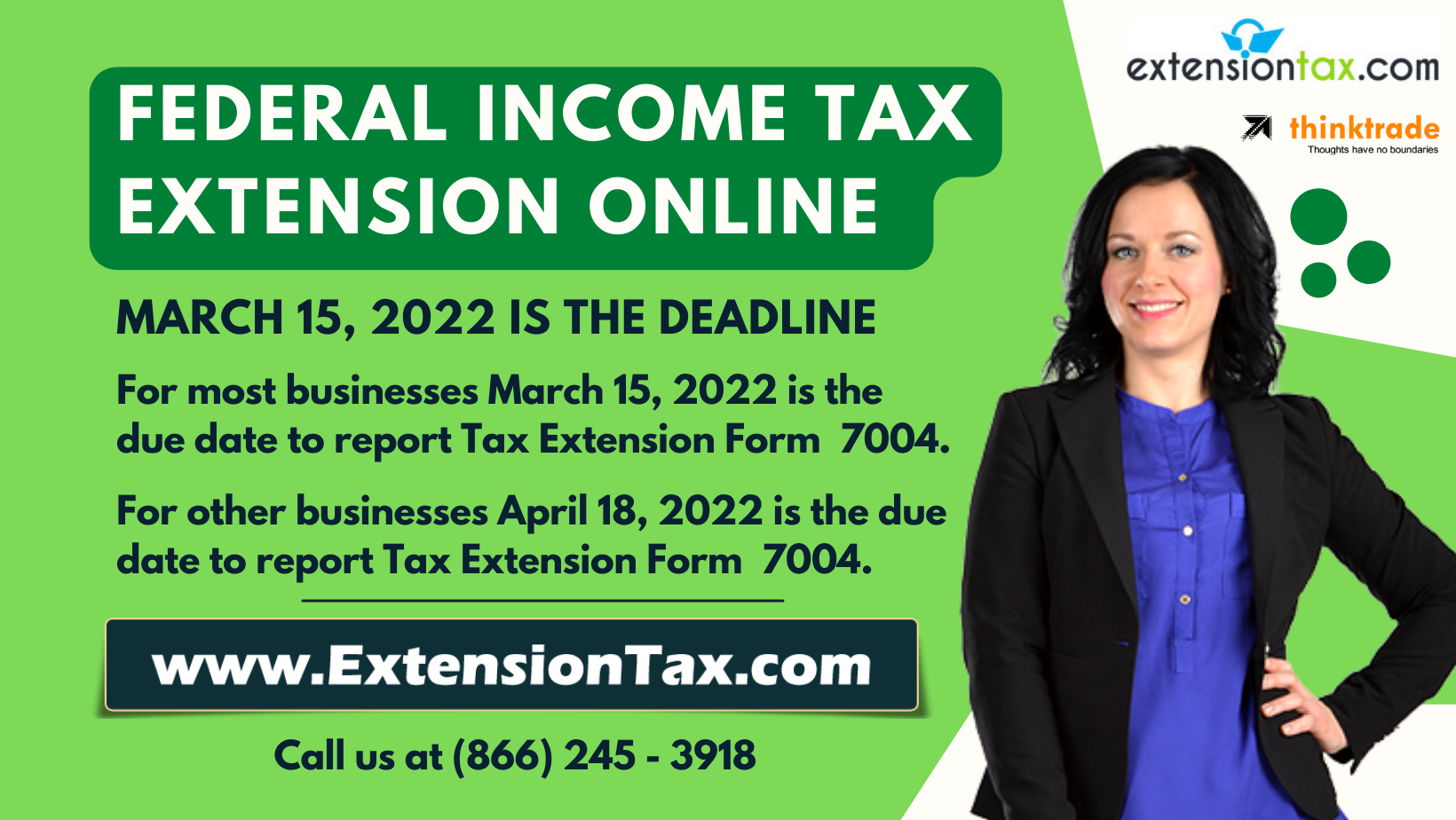

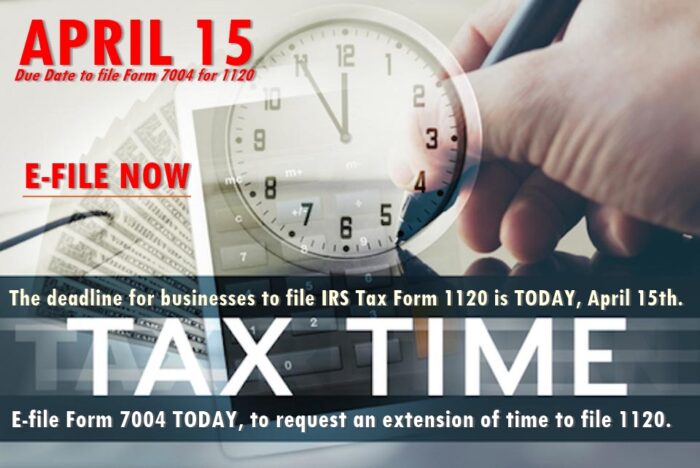

Hello taxpayers, IRS made e-filing possible to apply for business tax extensions online through its authorized e-file service providers. You can choose your convenient best e-filing service provider to e-file form 7004 business tax extension to get the additional time to report your taxes to the IRS. The deadline to e-file business tax extension form 7004 is March 15th, 2022. You will get an automatic tax extension time of six months to file your complete reports along with the supporting documents for the tax year to the IRS. But the six months tax extension period is not applicable for tax due payments. You should estimate your tax payments and pay them fully by March 15th. You will get the time till September 15th, 2022 (six-month extension time) to submit all the documents to the IRS without any late charges and interests.

Extensiontax.com is the first tax extension forms e-filing service provider to get approved and authorized to officially facilitate tax extension applications from the IRS. Let us look into the benefits and comforts of e-filing form 7004 business income tax extension at extensiontax.com. Continue reading