Hello taxpayers! Today is the last date to report your personal income tax form or apply for income tax extension form 4868 to get extra time from the IRS to report your taxes. It is common for all taxpayers to apply for an extension to submit the tax reports accurately with supporting documents and proofs. Sometimes, taxpayers can’t finish preparing their tax reports on time. Therefore, the IRS grants an automatic six-month extension to submit the income tax reports. So, if you are an income taxpayer and need to extend your tax reporting time, you must apply for personal income tax extension form 4868 within the end of this day.

Category Archives: efile income tax extension

Simplify your Personal Income Tax Extension Form 4868 Application with ExtensionTax.com!

This message is for all personal income taxpayers! The last date to report and pay your income tax for 2022 is April 18, 2023. Therefore, you must report your income taxes to the IRS by the due date or apply for personal income tax extension form 4868 by the same date to get the automatic six-month extension time to file your tax returns. It would be best if you remembered that the extension period is not applicable for tax payments; the taxpayers should pay the taxes fully using the parent form and apply for form 4868 to get extra time to submit the tax reports accurately with proof to the IRS.

As the last date to apply for personal tax extension form 4868 comes in less than a week, it is effective that you choose to e-file form 4868 in ExtensionTax.com. It is a simple process where you can apply form 4868 online on the go and enjoy the extra time from the IRS.

Get extension time to report your 2022 personal income taxes now!

Hello taxpayers! We understand that you are facing difficulties in preparing and filing your tax reports to the IRS on time. You can easily take an extension from the IRS to report your individual income tax returns with proof and supporting documents. File form 4868 and get the automatic six-month time to report your personal income taxes. IRS will not ask for any reason for your extension application; you can file form 4868 and extend the deadline to report your income taxes to the IRS.

But you must file the income tax extension form 4868 within the deadline, which will arrive in just a few days. April 18, 2023, is the last date to apply for form 4868 and get the automatic six-month extension to submit your individual income tax reports to the IRS. Therefore, you don’t have to wait till the last date to file your tax reports. You can file form 4868 on ExtensionTax.com today, sit back, relax, and have more time to accurately file your income tax returns.

Today is the last date to apply for Business Income Tax Extension Form 7004!

Hello business taxpayers! Today is the last date to report your business income tax extension form 7004. Many businesses file for business income tax extension form 7004 to get the automatic six months extension time from the IRS because they can’t report the tax returns with all supporting documents and proofs.

Among the many businesses, the last day to apply for business income extension tax form 7004 is today for the companies like LLCs, S-Corporations, Partnership firms to get the automatic six-month tax extension till September 15, 2023.

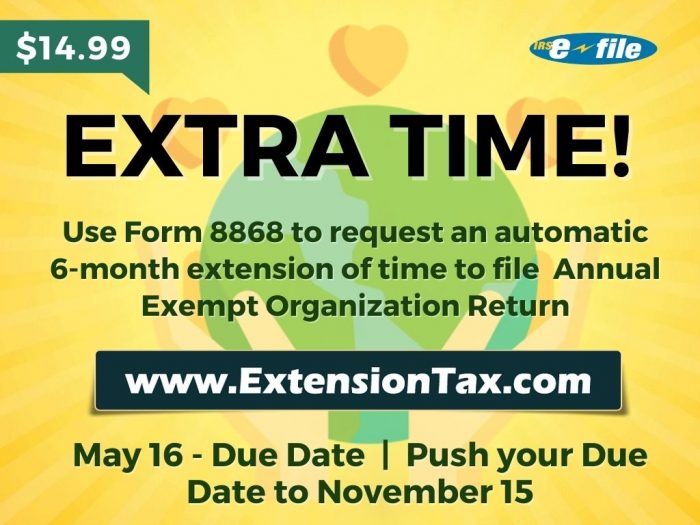

Business Tax Extension Form 8868 is due today for Tax-Exempt Organizations

Hello Taxpayer! Today is the deadline to apply for a business tax extension for your tax-exempt organizations. Non-profit and tax-exempt organizations are not liable for any taxes because they are excluded from any taxes by the federal government. But they have to file their business income tax reports to the IRS within the deadline. If they cannot report the taxes for the previous year within the deadline, they should apply for a tax extension to the IRS and get the automatic tax extension time to report their business income taxes.