Hello Taxpayer! Today is the deadline to apply for a business tax extension for your tax-exempt organizations. Non-profit and tax-exempt organizations are not liable for any taxes because they are excluded from any taxes by the federal government. But they have to file their business income tax reports to the IRS within the deadline. If they cannot report the taxes for the previous year within the deadline, they should apply for a tax extension to the IRS and get the automatic tax extension time to report their business income taxes.

Tag Archives: efile form 8868

IRS has issued an update on processing Exempt Organizations filing Form 990 series

IRS has sent a recent update on processing Exempt Organizations Tax return filed in Form 990 series…

Form 990 processing changes

As of January 8, the IRS is returning Form 990 series returns filed on paper – and rejecting electronically filed returns – when they are incomplete or the wrong return. IRS.gov answers the question What happens if my Form 990 is missing information or a schedule, or is the wrong return?

Form 990-EZ reminders

Tax-exempt organizations with annual gross receipts under $200,000 and assets under $500,000 (at the end of the reporting period) can use Form 990-EZ, Short Form Return of Organization Exempt from Income Tax, to meet their annual filing requirement. This means you’ll submit less information and fewer schedules than the “full” Form 990, Return of Organization Exempt from Income Tax.

Form 990-EZ includes “assistive” features designed to make filing easier, quicker, and more accurate. These 29 “help buttons” don’t replace the instructions, but they do alert the filer to traditionally troublesome areas and have decreased the error rate for paper-filed returns.

The IRS encourages exempt organizations to file electronically, noting the error rate for electronically-filed returns was only 1% for 2017. A list of companies providing this service is on IRS.gov.

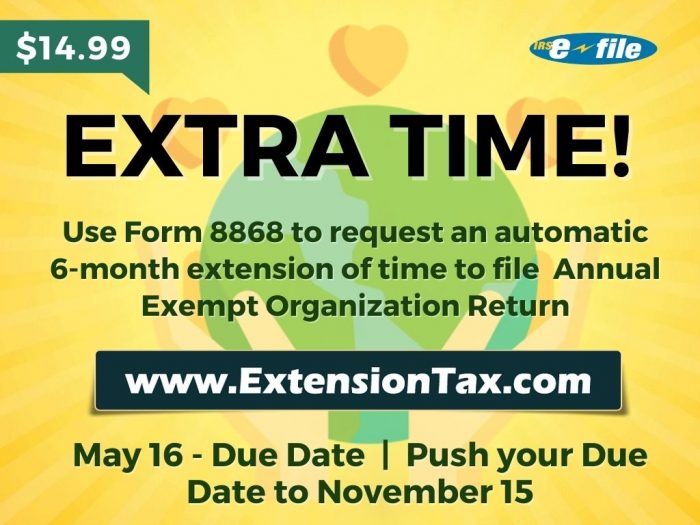

Form 990-series returns are due on the 15th day of the fifth month after an organization’s tax year ends. For organizations using the calendar year as their tax year, May 15 is the deadline to file for 2017. If you need an extension of time to file, use Form 8868, Application of Extension of Time to File an Exempt Organization Return.

IRS Form 8868: Extension of time to file Exempt Organizations taxes.

Are you an exempt organization, needing more time to file your IRS income taxes? The deadline is May 16th, but if you know that isn’t enough time, you can e-file a tax extension with www.extensiontax.com . To be precise, you will e-file IRS Form 8868 – Exempt Organizations Tax Extension. Continue reading

Form 8868 Tax Extension For Non-Profit Organization

May 15th is right around the corner and it means that Charities and Non-Profit (Exempt) organizations are now busy preparing their tax returns. Unlike businesses and individuals, the tax deadline for these types of organizations is May 15th (if their tax year is a calendar year).

May 15th is right around the corner and it means that Charities and Non-Profit (Exempt) organizations are now busy preparing their tax returns. Unlike businesses and individuals, the tax deadline for these types of organizations is May 15th (if their tax year is a calendar year).

If an exempt organization does not have enough time to prepare their tax return, the IRS will allow an additional 3 months to file the return if a Form 8868 is filed by the deadline. An IRS Form 8868 is an application for 3 Month extension of time to file a tax return for a Non-Profit Organization. This form can be filed electronically throughExtensiontax.com an IRS Approved E-File Provider.

This is the fastest and safest way to file for a tax extension. E-Filing form 8868 takes only few minutes and within minutes from filing, the IRS will accept the form. Once the form is accepted, the filer will receive an email from Extensiontax.com.When paper filing this form there is no letter of acceptance, but it is nearly instant when e-Filing.

NOTE : A tax extension does not extend the amount of time to pay the tax. It extends the amount of time to file the official tax return. Any taxes due will still be due on thetraditional deadline or else there will be additional penalties and interest.

E-Filing form 8868 through Extensiontax.com is the easiest way of filing it. The application is very simple. Instead of filling out a complicated tax form, there are just a series of easy to answer questions. Extensiontax.com has simplified all the confusing tax jargon’s and created an incredibly simple application to E-File form 8868 with the IRS.

www.ExtensionTax.com is committed to provide the Best in Quality and Service for all our users, www.ExtensionTax.com / www.TaxExcise.com is a certified, IRS authorized, e-file service provider for Form 2290, Form8849, Form720 & Extensions for Form4868, Form8868 and Form7004.

www.ExtensionTax.com / www.TaxExcise.com are products of Think Trade Inc. We are a BBB accredited company with A+ certification.For any questions you may have regarding Excise Tax Filings please reach us at 1-866-245-3918 or simply write to us at support@extensiontax.com / support@taxexcise.com.

Can’t File By April 17? Use ExtensionTax.com to E-File to Get a Six-Month Extension

Can’t File By April 17? Use ExtensionTax.com to E-File to Get a Six-Month Extension

The Internal Revenue Service today reminded taxpayers that quick and easy solutions are available if they can’t file their returns or pay their taxes on time, and they can even request relief online.

The Internal Revenue Service today reminded taxpayers that quick and easy solutions are available if they can’t file their returns or pay their taxes on time, and they can even request relief online.

The IRS says don’t panic. Tax-filing extensions are available to taxpayers who need more time to finish their returns. Remember, this is an extension of time to file; not an extension of time to pay. However, taxpayers who are having trouble paying what they owe usually qualify for payment plans and other relief.

Either way, taxpayers will avoid stiff penalties if they file either a regular income tax return or a request for a tax-filing extension by this year’s April 17 deadline. Taxpayers should file, even if they can’t pay the full amount due.

Here are further details on the options available.

More Time To File

People who haven’t finished filling out their return can get an automatic six-month extension. The fastest and easiest way to get the extra time is through E-filing. In a matter of minutes, anyone can use this service to electronically request an automatic tax-filing extension on Form 4868.

Filing this form gives taxpayers until Oct. 15 to file a return. To get the extension, taxpayers must estimate their tax liability on this form and should also pay any amount due.

By properly filing this form, a taxpayer will avoid the late-filing penalty, normally five percent per month based on the unpaid balance, that applies to returns filed after the deadline. In addition, any payment made with an extension request will reduce or eliminate interest and late-payment penalties that apply to payments made after April 17. The current interest rate three percent per year, compounded daily, and the late-payment penalty is normally 0.5 percent per month.

IRS reports, Of the 10.5 million extension forms received by the IRS last year, about 4 million were filed electronically.

Some taxpayers get more time to file without having to ask for it. These include:

• Taxpayers abroad. U.S. citizens and resident aliens who live and work abroad, as well as members of the military on duty outside the U.S., have until June 15 to file. Tax payments are still due April 17.

• Members of the military and others serving in Iraq, Afghanistan or other combat zone localities. Typically, taxpayers can wait until at least 180 days after they leave the combat zone to file returns and pay any taxes due.

• People affected by certain tornadoes, severe storms, floods and other recent natural disasters. Currently, parts of Indiana, Kentucky, Tennessee and West Virginia are covered by federal disaster declarations, and affected individuals and businesses in these areas have until May 31 to file and pay.

Easy Ways to E-Pay

Taxpayers with a balance due IRS now have several quick and easy ways to electronically pay what they owe. They include:

• Electronic Federal Tax Payment System (EFTPS). This free service gives taxpayers a safe and convenient way to pay individual and business taxes by phone or online.

• Electronic funds withdrawal. E-file and e-pay in a single step.

• Taxpayers who choose to pay by check or money order should make the payment out to the “United States Treasury.” Write “2011 Form 1040,” name, address, daytime phone number and Social Security number on the front of the check or money order. To help insure that the payment is credited promptly, also enclose a Form 1040-V payment voucher.

www.ExtensionTax.com is committed to provide the Best in Quality and Service for all our users, www.ExtensionTax.com /www.TaxExcise.com is a certified, IRS authorized, e-file service provider for Form 2290, Form8849, Form720 & Extensions for Form4868, Form8868 and Form7004.

www.ExtensionTax.com /www.TaxExcise.com are products of Think Trade Inc. We are a BBB accredited company with A+ certification.For any questions you may have regarding Excise Tax Filings please reach us at 1-866-245-3918 or simply write to us at support@extensiontax.com / support@taxexcise.com